There are many students who are on the verge of going into debt, although this number is quickly increasing each year. Before we discuss the various student loan forgiveness programs, first we need to specifically define the differences between forgiveness, cancellation and discharge.

Now, all these terms mean the same, however they are used very differently based and can vary based on the context. If you are a student who is struggling to pay off their loans, once he/she is forgiven, they will no longer be legally required to make loan repayments on their existing student loan. This can also be referred to a cancellation.

Loan discharge is when a student does not have to make payments towards their existing loan due to an unforeseen circumstance. This will occur in the event of a total and permanent disability caused by an accident or the closure of the school for which the student initially acquired the loan.

What are the Types?

The list below contains information on the various types of student loan forgiveness programs available on federal student loans.

Teacher Loan Forgiveness – This type of loan forgiveness program can be applied for the Federal Family Education Loan Program (FFEL) and direct loans.

If you are a teacher who is employed full-time in a low-income elementary or secondary school or an educational service agency and has been working in that institution for a period of 5 consecutive academic years, you will be eligible to apply for this forgiveness program.

The teacher loan forgiveness can grant an amount of up to $17,500 on the FFEL program or on direct loans.

Closed School Forgiveness – This type of loan forgiveness program is applicable on Perkins loans, direct loans and on FFEL program loans. In the event of the educational institution shutting down while you are still enrolled in a particular course, you will be eligible to discharge your federal student loan.

Perkins Loan Cancellation and Discharge – This type of loan forgiveness program is available exclusively on Federal Perkins loans. If you have availed a Perkins loan, based on your current employment status you will be eligible to get a portion of the remaining amount cancelled or in some cases, the whole loan amount due can be forgiven.

Total and Permanent Disability Forgiveness – This type of loan forgiveness program can be availed on direct loans, Perkins loans and FFEL program loans. If you have, due to some unforeseen circumstance, totally and permanently disabled, you are eligible to apply for this student loan forgiveness program.

You can get your federal student loans discharged if you are part of the Teacher Education Assistance for College and Higher Education (TEACH) initiative or the Grant service obligation.

Loan Forgiveness Due to Death – This is available for Perkins loans, direct Loans and the FFEL program loans. In the event of the death of a borrower, the federal student loan will be discharged. This is also applicable if the student has taken out a Parent PLUS loan on behalf of a parent or guardian..

Loan Forgiveness Due to Bankruptcy – This type of loan forgiveness program can be availed on Perkins loans, FFEL Program loans and direct loans. When the borrower files for bankruptcy, their student loan will automatically be discharged.

However, keep in mind that filing for bankruptcy can severely decrease your chances of reapplying for any type of loan in future. It may take years to come out of this process and you will also have to rebuild your credit score from scratch.

Forgiveness in the Case of Borrower Defense to Repayment – This type of loan forgiveness program is available only on direct loans. If you have a FFEL program loan or a Perkins loan, there is a small chance to avail this forgiveness program but you will have to consolidate these loan types into a direct loan first.

In the case where the borrower has availed a student loan in order to pay for an education course or enroll in a university but then, the institution failed to accept the loan or had loan related issues, then you can apply for the borrower defense to repayment forgiveness program.

What is the Public Service Loan Forgiveness Program?

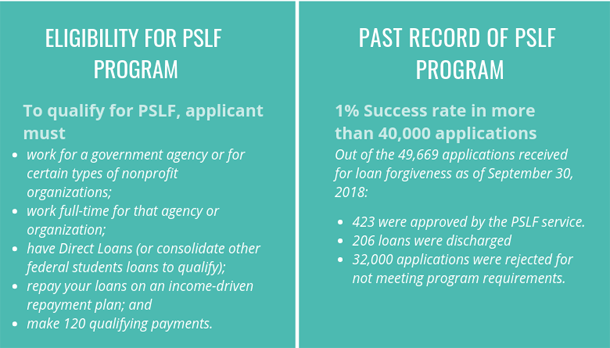

The Public Service Loan Forgiveness (PSLF) was implemented for students who are having financial troubles and cannot repay their loan amount. This federal program specifically encourages students who are employed in fields such as government administration, teaching, military, nursing and any other public sector job.

To be eligible for the PSLF program, the borrower will need to have made payment towards their student loan for at least 10 years. This repayment cycle should take place while the borrower is employed in a government or public service job or in a nonprofit organization.

There are many instances when the borrower’s application gets rejected due to them failing to meet the following requirements.

- The borrower must ensure that they have the correct type of loans which qualify for this program.

- The borrower must ensure that they have made 10 years worth of loan repayments.

- The borrower must hold full time employment (part time jobs will not qualify).

- The borrower must also consider if switching to an income-driven repayment plan will make the loan payments easier.

If you have met all the conditions listed above, the chance of you getting an approval will be much higher but there is no sure-fire guarantee. In case you still fail to qualify for the public service loan forgiveness program, you can always consider applying for the other forgiveness programs.